Whatever you do today, do it justice.

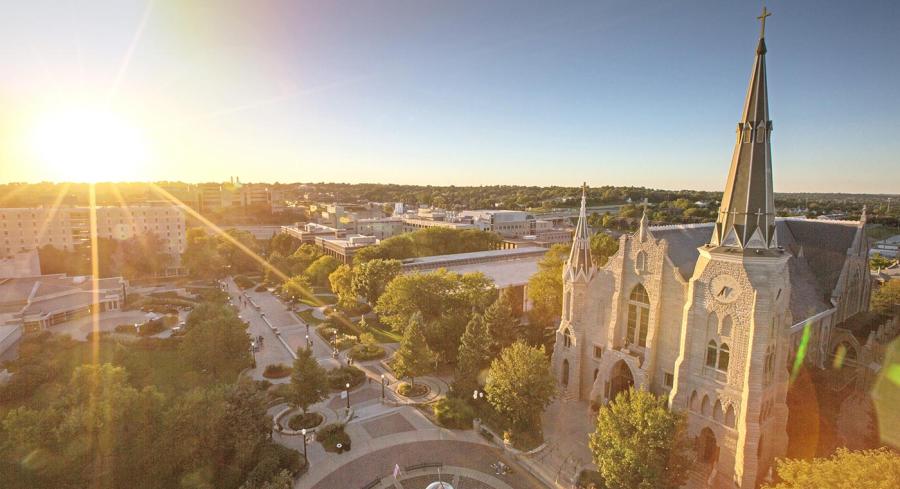

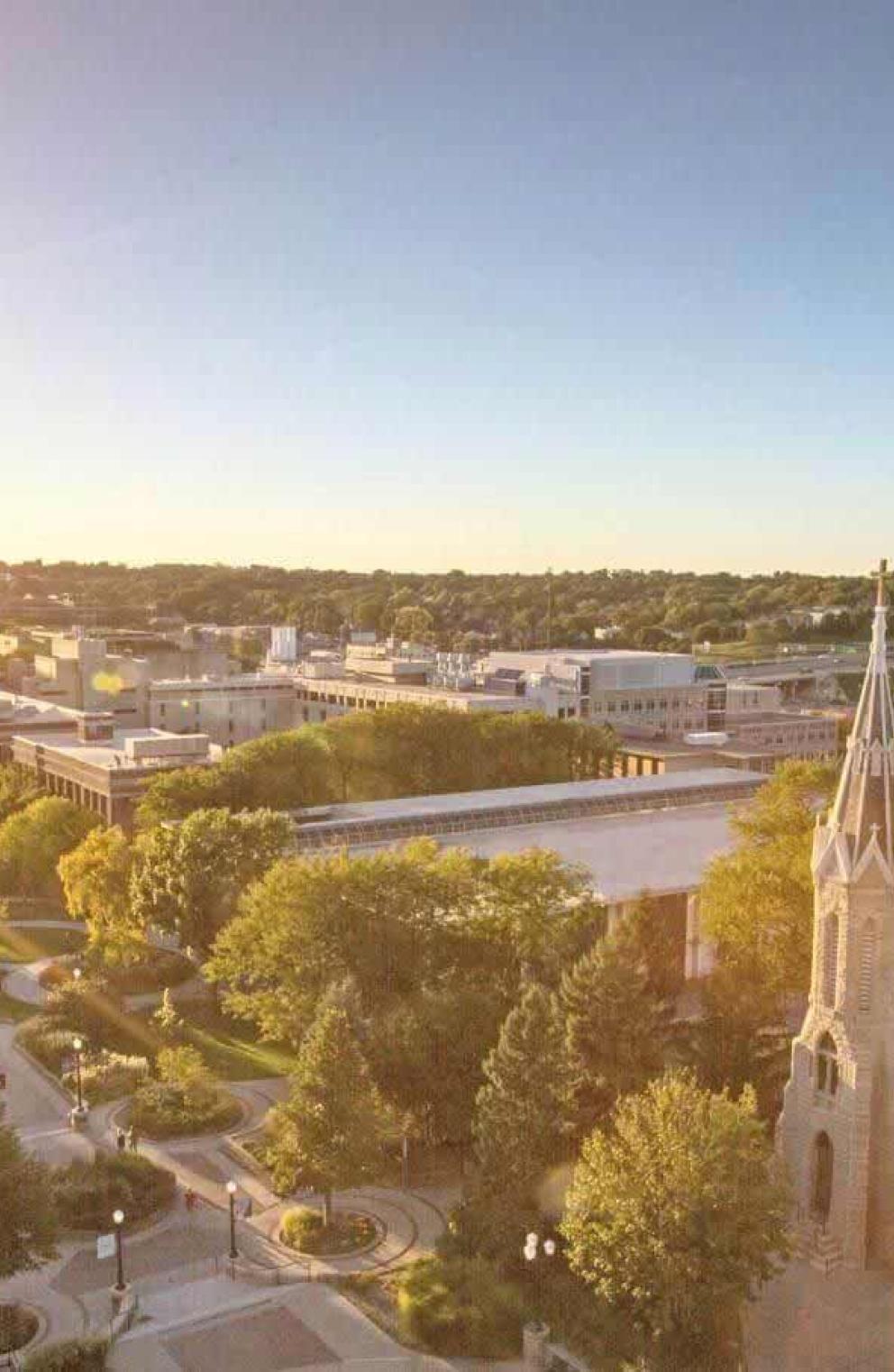

With leading academics and a common set of Jesuit values, Creighton grads bring fire to their life’s work. This is an education for those who believe in a better world.

How we work.

Bring your passion to Creighton University, and we’ll supply the fuel to propel you forward.

Creighton professors are attentive to your goals and supportive as you reach for them. Our academic programs illuminate your understanding of the world. And the community we build together prepares you to live well and do good in the world throughout your career.

Image

Image

Bluejays, always.

You can graduate from Creighton, but you never leave the nest. Here are a few great ways to stay connected as a Bluejay for life.